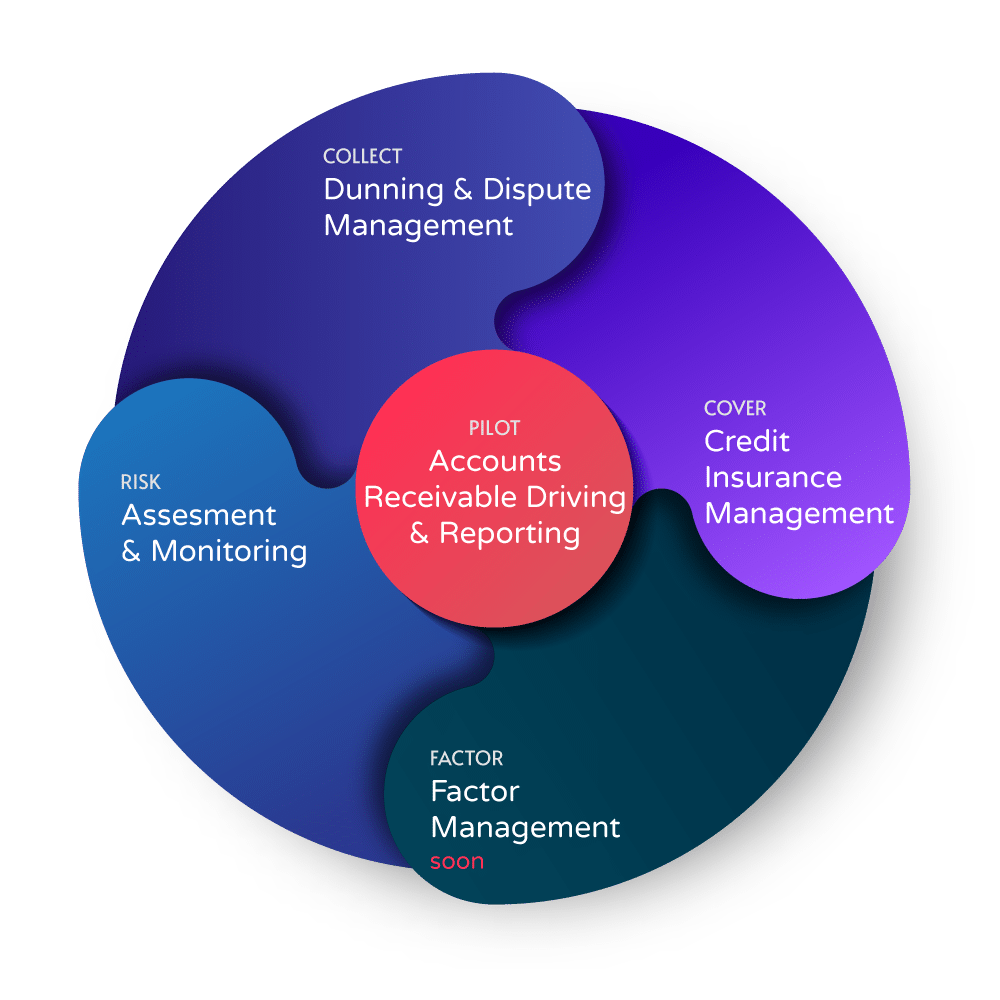

Hoopiz is a complete and collaborative software thanks to all the features of Customer Risk Management and Debt Recovery. It is also easy to use and adapts to all business organizations thanks to its great modularity.

Credit Management & Debt Collection Software

Agile and accessible Credit Management

Optimized and secure Credit Management

STEP 1

Study of your business processes and resources by our project Credit Manager.

STEP 2

Configuration of the software according to your needs and objectives by our IT department, then you have to validate the conformity.

STEP 3

Training your financial and sales teams in the use of the platform and best practices.

STEP 4

Performance support for the continuous improvement of your entire customer credit cycle.

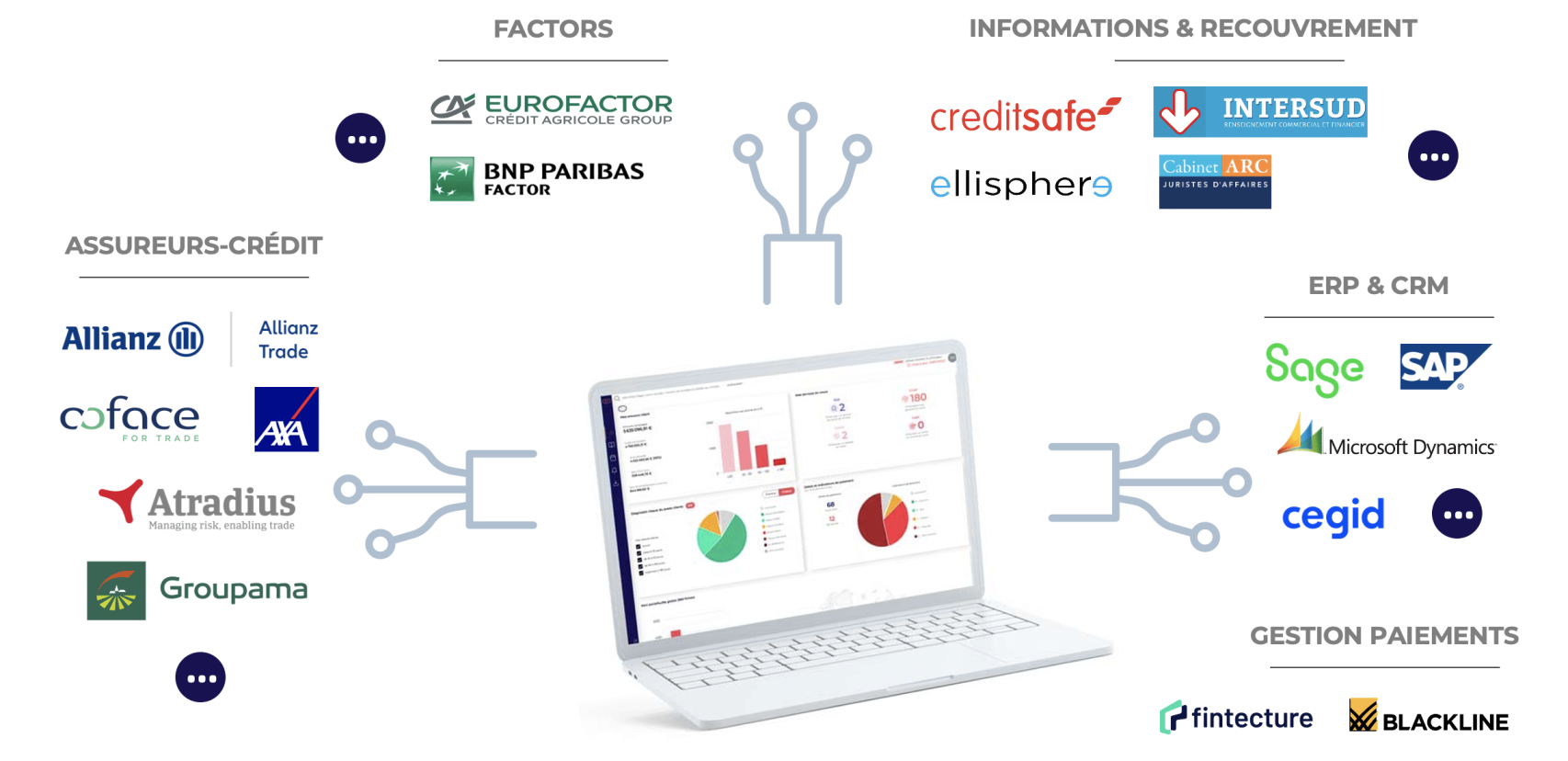

Centralized and connected Credit Management

Hoopiz is compatible with all accounting, CRM or ERP systems, and connects to your entire financial and application ecosystem. Multi-company, Multi-currency and Multilingual management.

Integrate your already subscribed financial services, or use services available on the platform.

Our numerous connectors allow you to centralize data and control your financial information, security, recovery and financing services.

You don’t have such services? Thanks to our partners, you can use their services directly on the platform “on demand”.

Performance support

offered with our Credit Management solution

We bring digitalization, AI, Big Data to your customer credit management… but we first thought about the essential: human.

We are aware that a powerful tool must come with appropriate support in order to get the most out of it. We then offer regular working meetings between your company’s customer credit manager and his delegated Hoopiz Credit Manager on whom he can always count. This philosophy reflects the expert background of the creators of the solution.

Bad

debts

average

payment terms

available

cash-flow

save processing

time

Average results observed

I target my risks and customer reminders more quickly, and take action immediately.

Ludovic Berret

Administrative and Financial Manager of CTA France

Ready to take action?

Let’s get to know each other by videoconference. We will answer all your questions and study together how HOOPIZ could solve your specific challenges.

With more than 730 billion in inter-company credit in France, the risk linked to non-payment is a major financial issue for the proper development of any company. Better assess customer risk, secure cash flow, have a collaborative tool between financial management and the sales team, benefit from alerts, script reminders before and after due date,… our Credit Management platform deals with a very large number of issues. Connected to your information system (ERP, accounting software, etc.), the platform associated with our personalized support accelerates your processing times and optimizes your results.

It all starts with the automatic validation of the legal identifier and the possibility of filtering your portfolio on active clients whose identifier needs to be corrected. Then, obtain credit information in just a few clicks. Enrich this information with community information. Visualize on a map where your customers are located in the world for a geopolitical analysis of customer risk… The Customer Credit manager can then adapt his actions accordingly. He will be responsive by acting with complete confidence thanks to the relevance and diversity of the information that he has been able to acquire, centralize and analyze thanks to the Credit Management platform.

Managing and analyzing your customer base is essential. But taking action at the right time is vital. This is why, if you wish, Hoopiz can connect all your financial services to better manage them within the platform: financial information, credit insurance, factors, etc. If you don’t already have one, you will have then the possibility of very easily activating new services thanks to our premium partners.